Lump sum payroll tax calculator

This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Affordable Easy-to-Use Try Now.

2

Get Started With ADP Payroll.

. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. WinTax Calculator 200911 is a useful application which provides users with an easy way to calculate taxes on regular salary bonus retroactive pay and commission. This spreadsheet will help you calculate the lump sum calculations.

ATO app Tax withheld calculator. This will calculate net pay based on information entered and will provide a reasonable approximation of net pay. The online calculator will calculate the return generated ie 2895992 and the maturity amount ie.

A financial advisor in Virginia can help you understand how taxes fit into your overall financial goals. Use the Lump Sum vs. Price development of CHECK.

Please note that the expected returns is just an estimation based on the figures. All Services Backed by Tax Guarantee. Combine all lump-sum payments that you have paid or expect to pay in the calendar year when determining the composite rate to use.

Ad Process Payroll Faster Easier With ADP Payroll. By making a lump sum payment you will repay your loan 58 months earlier and save 9618 in. For example lets assume you have 50000 in student loans at a.

Use the following lump-sum withholding rates to. Discover ADP Payroll Benefits Insurance Time Talent HR More. Free Unbiased Reviews Top Picks.

By making a lump sum payment you will repay your loan 58 months earlier and save. Ad The New Year is the Best Time to Switch to a New Payroll Provider. Federal Bonus Tax Percent Calculator.

With Lump Sum Payment. A lump-sum distribution is the distribution or payment within a single tax year of a plan participants entire balance from all of the employers qualified plans of one kind for example. This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States.

She wants to know what that. With Lump Sum Payment. From 1 April 2022.

Months to Pay Off. The key is to. By making a lump.

Get Started With ADP Payroll. The ATO app includes a simplified version of the Tax withheld calculator for use by employers and workers. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Compare the Best Now. Find 10 Best Payroll Services Systems 2022. Lump sum investing calculator for Paycheck CHECK backtesting.

Use this calculator to help determine whether you are better off receiving a lump sum payment and investing it yourself or receiving equal payments over time from a third party. In the context of pensions the former is sometimes. If your state does.

This may be useful to help you determine the maximum amounts an employee can defer in a full month andor partial. It will take between 1 and 2 minutes to use. Were often asked about tax brackets and how it works when lump sums of money are taken such as 401k distributions severance pay one-time pension payouts etc.

Lump Sum Net Pay Calculator This calculator is for estimating purposes ONLY. Most DB plans offer the option of a one-time lump sum payment or monthly benefit payouts. Free Unbiased Reviews Top Picks.

Ad Process Payroll Faster Easier With ADP Payroll. Ad Compare This Years Top 5 Free Payroll Software. Investing 100 in CHECK on Mar 2022 would result in.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Enter the lump sum amount you have to invest to calculate monthly income. You can use a lump sum extra payment calculator to calculate how much money you can save with a lump sum payment.

Paula is 63 years old and has 100000 to invest in an annuity. Months to Pay Off. Enter up to six different hourly rates to estimate after-tax wages for.

Financial advisors can also help with investing and financial plans including retirement. Ad Compare This Years Top 5 Free Payroll Software. Total of lump sum payment and grossed-up annual value of employees income including the secondary tax codes low threshold amount if appropriate PAYE rate.

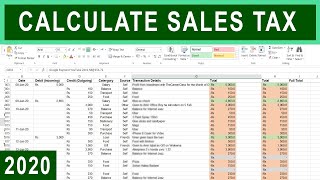

How To Calculate Sales Tax In Excel Tutorial Youtube

Lottery Tax Calculator

Tax Calculator Estimate Your Income Tax For 2022 Free

Pin On Accounting Blog

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Simple Tax Refund Calculator Or Determine If You Ll Owe

How To Calculate Net Pay Step By Step Example

Marginal And Average Tax Rates Example Calculation Youtube

Infographic How Can You Use Home Equity Reverse Mortgage Home Equity Mortgage Amortization Calculator

Bonus Calculator Percentage Method Primepay

Federal Income Tax Calculator Atlantic Union Bank

How To Calculate Loan Payments And Costs Nextadvisor With Time

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

How To Use A Salary Calculator Explained

Flat Bonus Pay Calculator Flat Tax Rates Onpay

Llc Tax Calculator Definitive Small Business Tax Estimator

How Bonuses Are Taxed Calculator The Turbotax Blog